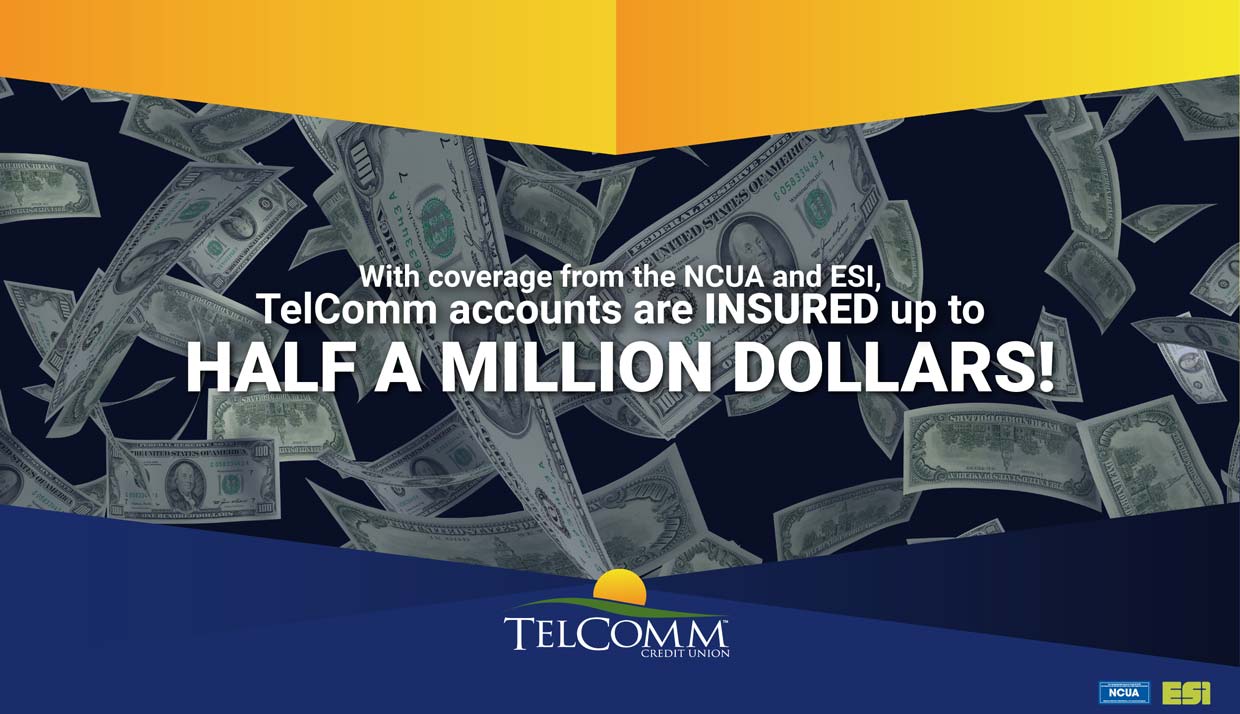

The NCUA is to credit unions what the FDIC is to banks. In function, they’re pretty similar — agencies who insure deposits in the unlikely case an institution fails. Not one penny of insured savings has ever been lost by a member of a federally insured credit union that provides free account insurance. And just like with the FDIC, the NCUA, insures each credit union account up to $250K.

TelComm CU takes account protection to the next level, providing members with an additional $250K of account insurance FREE through Excess Share Insurance (ESI). Not something everyone does and also not something paid for by members. Our way of making sure you are as protected as possible.