A TCU Debit Card makes life much easier and more secure.

Your TelComm CU Debit Card is accepted at millions of locations worldwide and is easier and more secure than using cash or checks. Plus, it allows you to shop online, in stores, or over the phone.

A debit card withdraws money directly from your checking account, just like a check, at any place that accepts MasterCard. Use the card like a credit card—just insert or swipe and sign. Since various merchants require PIN (Personal Identification Number), TelComm CU strongly encourages members to create a PIN for both your Debit and Credit Cards. This is the best way for everyone to be adequately prepared.

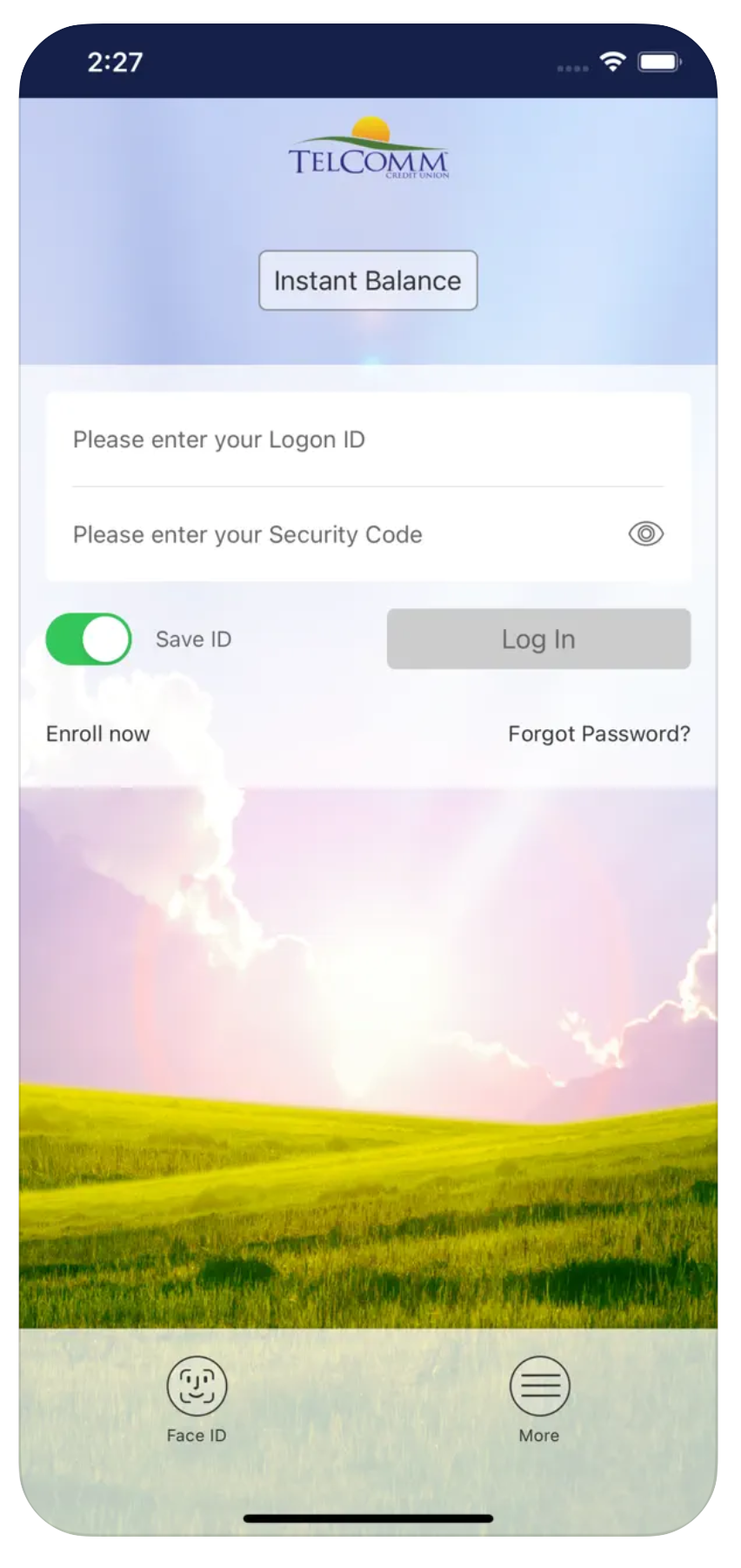

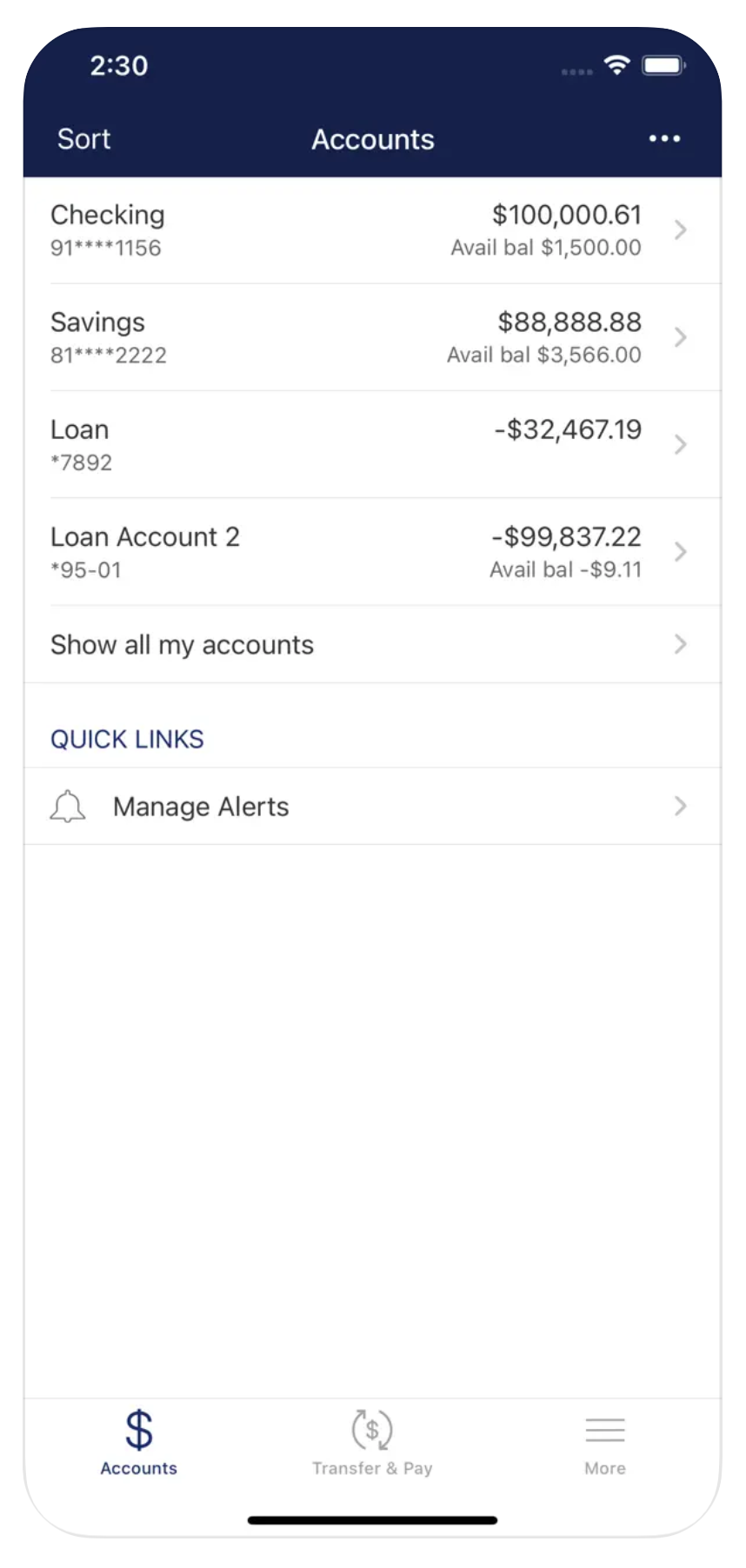

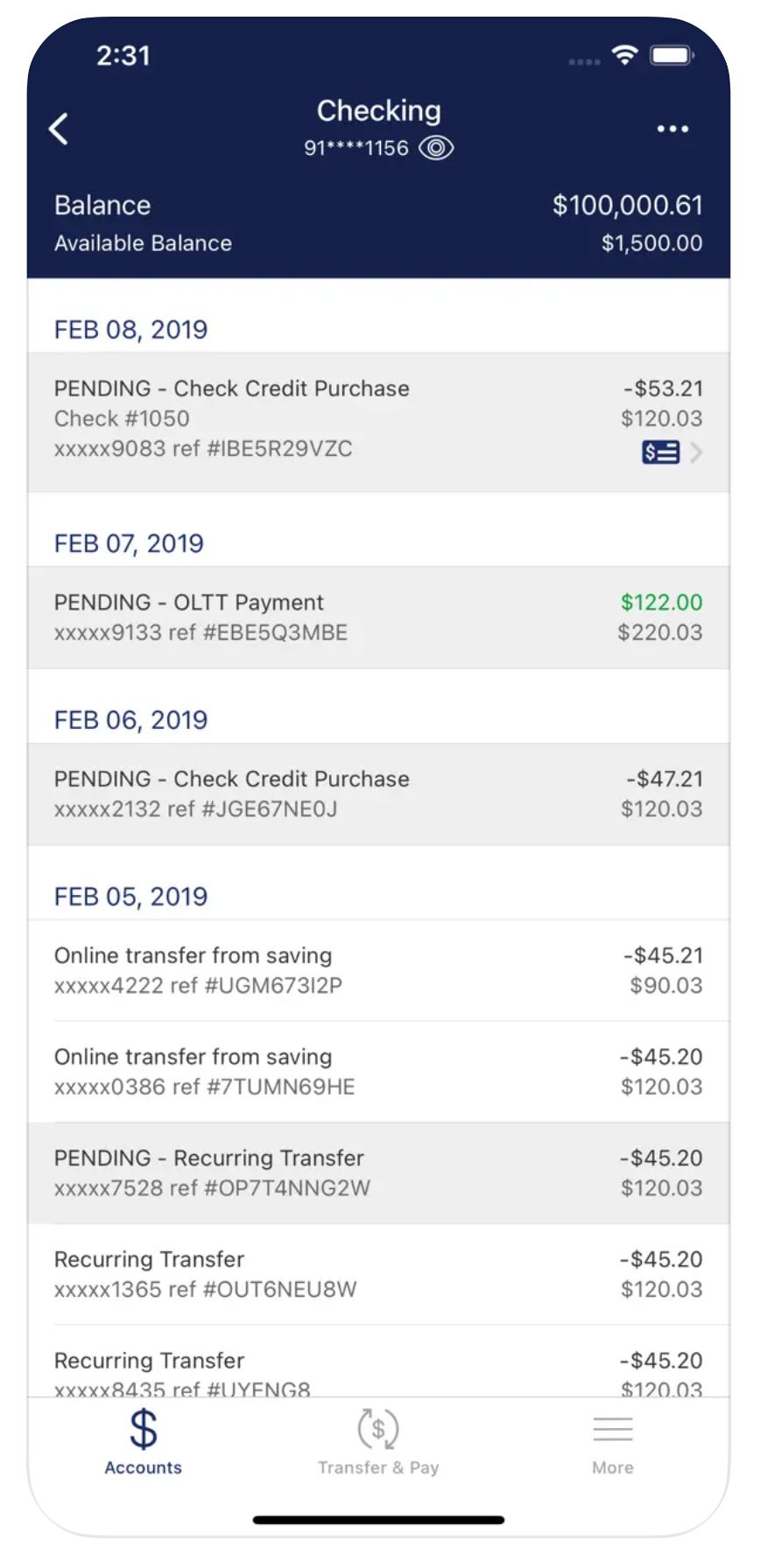

Your debit card also works like an ATM card, giving you access to cash machines worldwide via your PIN. Check your balances or withdraw funds from savings, checking, or overdraft accounts (up to $510 daily). The daily purchase limit is $1,500.00. You may view your complete transaction history through TCU Online at TelCommCU.com or on our TelComm Mobile App.

Don’t Forget The Perks

Get Instant Issue Debit Cards When You Open Your Account

Get your card instantly when you become a member with a $25 minimum deposit. Once your deposit is verified in your account, your card is created.

Cards are printed at our Sunshine, Battlefield, Nixa and Republic, MO locations Monday through Friday. If you’re opening an account at any of these 4 locations, your Debit card will be available immediately. If you’re opening an account at our Chestnut or E. Republic St. location, your card will be available within hours for pickup at our Sunshine location.

Card Design Options

Swipe & Sign

When using your plastic cards at merchants, please consider the “Swipe and Sign” option without a PIN number to save time and hassle. Not only does the “Swipe and Sign” option save time, it also saves TelComm money in transaction fees. In order words, “Swipe and Sign” is the ultimate win-win for everyone!

Report Lost or Stolen Debit Card

To report a lost or stolen debit card call 1.800.472.3272

To learn why a charge was denied after TelComm business hours within the United States, call 1.800.992.3808; if traveling internationally, please call collect 1.636.722.7111. You will be asked your name, phone number and Social Security number for verification.

In case of Emergency, contact MasterCard at 1.800.627.8372

Card Fraud Protection Phone Numbers

TelComm offers FREE card fraud monitoring, this allows members to receive text message alerts when suspicious activity is flagged on their debit or credit cards. Members will be notified when a transaction is marked as suspicious and be able to lock or unlock their accounts with a single text. For this additional service, PLEASE MAKE SURE WE HAVE YOUR CURRENT CELL PHONE NUMBERS ON YOUR TELCOMM ACCOUNT.

What You Need to Know About Fraud Text Alerts:

- Text alerts are sent upon notice of flagged suspicious activity of the card holder’s account. Alerts are sent during the local time of 8am–9pm based on the cell phone number area code on the account.

- Once a text alert has been sent through the system and there is no response to the text alert within 15 minutes, the system will move on to calling each number listed on file to alert by phone.

- You do not need to respond to an enrollment text in order to begin receiving alerts, you are automatically enrolled to enhance account security.

- You can opt out at any time. Text “STOP” when you receive a fraud text alert.

- Responding by texting “HELP” will help you get in touch with a Fiserv Call Center associate.