FREE and Convenient Checking, with Interest!*

Don’t Forget The Perks

Get Instant Issue Debit Cards When You Open Your Account

Get your card instantly when you become a member with a $25 minimum deposit. Once your deposit is verified in your account, your card is created.

Cards are printed at our Sunshine, Battlefield, Nixa and Republic, MO locations Monday through Friday. If you’re opening an account at any of these 4 locations, your Debit card will be available immediately. If you’re opening an account at our Chestnut or E. Republic St. location, your card will be available within hours for pickup at our Sunshine location.

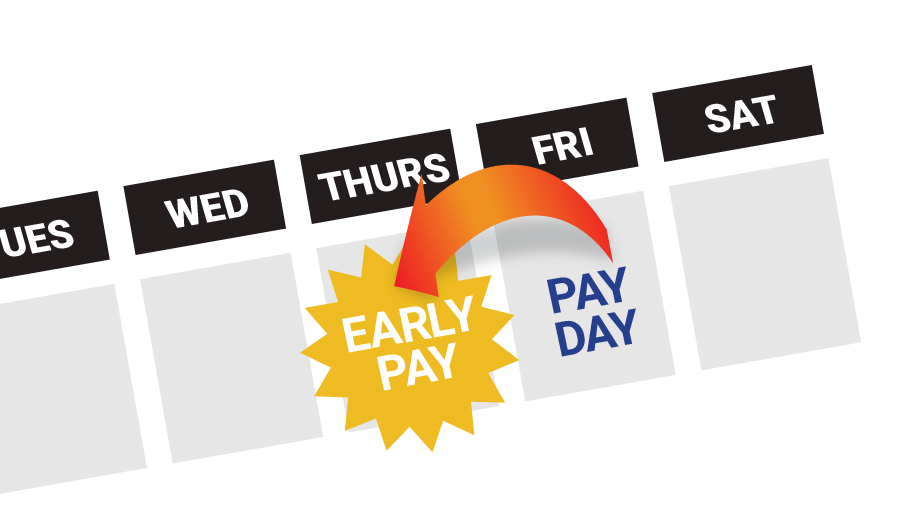

Get Paid A Day Early

With Early Pay from TelComm

Early Pay gives you access to your eligible direct deposits up to 24 hours early at no cost. There is no need to enroll or sign up for Early Pay; it is automatically available for all TelComm Checking and Savings accounts with set and qualifying direct deposits.