Few numbers matter as much as your credit score. Difficult to build and easy to damage, credit is one of the most important determining factors that shape your financial life. It impacts loan approvals, interest rates, and even insurance costs. If you have a good credit score, you’re more likely to save money in other areas as well.

Understanding how this score is determined, what helps it, and what hurts it is an essential part of maintaining strong financial health.

What is a Good Credit Score

Credit scores usually fall between 300 and 850, where higher scores reflect better credit reliability. A lot of things impact your credit score, including payment history, length of accounts, and credit utilization.

Here is a general breakdown of what these scores mean:

- Excellent (800-850): Borrowers in this range receive the best interest rates, highest credit limits, and most favorable loan terms.

- Very Good (740-799): Still considered a strong score, offering competitive loan terms and lower interest rates.

- Good (670-739): Generally qualifies for favorable credit terms, though not as competitive as very good or excellent scores.

- Fair (580-669): May qualify for credit, but often at higher interest rates with fewer benefits.

- Poor (300-579): Difficult to obtain credit, and if approved, terms will be costly with high interest rates.

Lenders, insurers, and landlords use these score ranges to assess financial responsibility, impacting everything from borrowing opportunities to monthly expenses.

How Your Credit Score Affects Interest Rates

One of the biggest ways your credit score impacts your finances is through interest rates on loans and credit lines. Lenders use your credit score to assess your reliability as a borrower. A high credit score generally means lower interest rates, while a low score can result in higher borrowing costs.

For example, a person with excellent credit might qualify for a mortgage with a 4% interest rate, whereas someone with poor credit could be offered a 7% rate. Over the life of a 30-year mortgage, this difference could amount to tens of thousands of dollars in extra interest payments.

The same principle applies to auto loans, personal loans, and even student loans. Better credit translates to better terms.

Credit Score and Buying Power

Your credit score directly impacts your buying power by determining the amount of credit lenders are willing to extend. With a high credit score, you may qualify for larger loan amounts or higher credit limits. This can be especially important when making significant purchases, such as buying a vehicle or a home.

On the other hand, a low credit score can limit your borrowing power. You may be approved for only smaller loans or lower credit limits, which could make it difficult to afford major purchases. Worse, lenders may require larger down payments or additional collateral to ease their risk, putting additional financial strain on you.

The Effect on Insurance Rates & Costs

Many people don’t realize that credit scores also influence insurance rates. Insurance companies use credit-based insurance scores to help determine risk levels. Studies have shown that individuals with lower credit scores tend to file more claims, leading insurers to charge them higher premiums for auto, homeowners, and even renters insurance.

For instance, someone with excellent credit may pay significantly less for auto insurance compared to someone with poor credit, even if the drivers have identical driving records. Maintaining a strong credit score can help keep your insurance costs down.

Credit Card Offers & Rewards

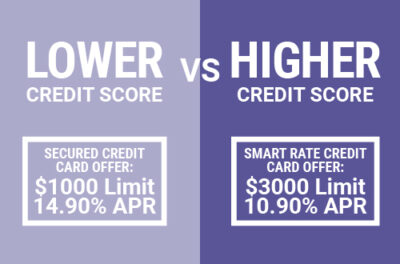

A high credit score also opens the door to better credit card offers. Premium credit cards with lower interest rates, higher credit limits, and lucrative rewards programs are often only available to individuals with good to excellent credit.

By contrast, those with lower credit scores may only qualify for high-interest credit cards or secured credit cards that require an upfront deposit. These cards can still help you raise your credit score but may lack the perks and benefits of other options.

Additional Impacts of a Low vs. High Credit Score

A strong credit score can benefit you in many other ways, including:

- Easier Rental Approvals: Landlords often check credit scores before approving rental applications. A higher score increases your chances of securing an apartment with favorable lease terms.

- Employment Considerations: Some employers check credit reports (with your permission) as part of the hiring process, particularly for roles involving financial responsibility.

- Lower Security Deposits: Utility companies and cell phone providers may waive security deposits for customers with good credit, reducing upfront costs when setting up new accounts.

How to Improve Your Credit Score

If your credit score isn’t where you’d like it to be, here are some steps to improve it:

- Make on-time payments – Your payment history is the biggest factor affecting your score.

- Reduce credit card balances – High credit utilization can negatively impact your score.

- Avoid opening too many new accounts at once – Each credit inquiry can lower your score slightly.

- Keep old accounts open – The length of your credit history plays a role in your score.

- Check your credit report for errors – Dispute any inaccuracies that could be dragging your score down.

Building a Healthier Financial Future

Your credit score is a critical component of your financial well-being, affecting everything from loan rates to insurance premiums and even job prospects. By maintaining a high credit score, you can access better financial opportunities and save money in the long run.

If your score needs improvement, taking proactive steps to manage your credit wisely can lead to long-term financial success. Like talking to TelComm Credit Union. We have 10 Certified Credit Union Financial Counselors who are available to help you at no charge.

As a member-owned not-for-profit, we invest in making financial services more accessible with lower rates and fewer fees than traditional for-profit banks. We will work with you to help determine the best way to start building or repairing damaged credit. Swing by any of our six locations to get the conversation started.