Exciting News: Increased Account Protection

TelComm Credit Union now offers up to $1,000,000 in account insurance coverage through combined National Credit Union Administration (NCUA) and Excess Share Insurance (ESI) protection.

We are committed to providing our members with the highest level of security for their savings. We are pleased to announce a significant enhancement to our account protection measures.

Enhanced Insurance Coverage

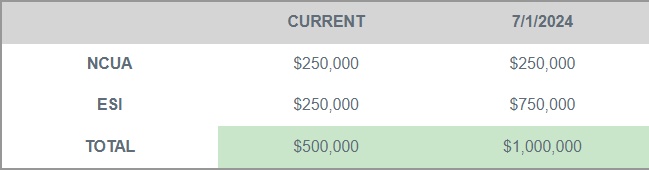

Beginning July 1st, 2024, TelComm Credit Union members will enjoy an unprecedented level of deposit insurance coverage at no additional cost to them. The Excess Share Insurance (ESI) coverage will increase from $250,000 to $750,000. Combined with the federal insurance provided by the National Credit Union Administration (NCUA), this means our members’ accounts will now be insured up to $1,000,000.*

Details of the New Coverage

To further protect your savings, TelComm offers a unique product among credit unions: Excess Share Insurance. This additional protection of $750,000 is provided at no cost to our members, layered on top of the current $250,000 insurance from the NCUA.

Here’s a breakdown of how this works:

How This Benefits You

This enhancement means greater peace of mind for you and your family. The combined coverage ensures that your hard-earned money is protected to the fullest extent, offering you security and stability. Not one penny of insured savings has ever been lost by a member of a federally insured credit union, and we are committed to maintaining this impeccable record.

At TelComm CU, your financial security is our priority. Our consumer account insurance is one of the highest available among local credit unions.

*For additional details about how to structure accounts to qualify for the maximum coverage amount, contact a credit union representative.